Public Mutual Bhd is launching a new fund, Public Australia Equity Fund (PAUEF) on 8 September 2009 to tap into the growth potential of the Australian Market. Its chief executive officer Yeoh Kim Hong said PAUEF would give investors the opportunity to capitalise on the long-term growth potential of the Australian market, given the country's strong position in natural resources and its diversified services sector.

The fund will mainly focus on sectors such as the natural resources, banking, real estate and consumer sectors. Please refer the url for more detail.

As usual, this new fund brought up some discussion among my friends at our kopitiam session ;)

Some said "well, it's potential"

Some said "i would rather invest in China Market"

Some said "how about the predicted performance?"

Some said "i am not interested in mutual fund. i am an equity guy."

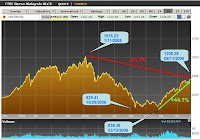

Whatever category you are, let review some data. I have compiled some of market movment of Equity Indexes that included US (DJI), Australia (S&P/ASX200), Hong Kong (HSI), Singapore (STI) and Malaysia (KLSE). I hope this data could help you up ;)

DJI

-32.2% from it's peak

+46.7% since march 2009

KLSE

-20.3% from it's peak

+44.1% since march 2009

Despite of the rebound since march 2009, most of the equtiy market is still underperform. Which market is more attractive to you? Another risk factor to think about it when investing oversea - currency exchange. I have compiled some of the past currency exchange data for AUD, CNY, HKD, SGD and MYR. In long term, which of the following currency will appreciate?

AUD - potential to appreciate vs the peak

SGD - potential to appreciate vs the peak

As usual unit trust is good for long term, diversification and frequent (dollar-cost-averaging) investment. So, I think its a 'safe' investment.

ReplyDeletebase on the performance of the australia dynamic fund since launched (~3 months), it able to give ~15% return with only 60% of its NAV (max) invested in the equity, ranked top 5 among the public mutual funds. this dynamic fund is a balance fund. if you look at the fund manager name, the 2 persons who manage the australia dynamic fund, are the 2 who manage this new australia equity fund as well.

ReplyDeleteaustralia equity fund is going to invest in similar way compare to the australia dynamic fund, but more aggresively (max 90% of NAV can be invested in equity), thus it should give better return during the economy downturn.

so, is it potential? yes, of course!

BUT how potential it is? it is all depends...

China is a known black horse, many ppl aiming to earn big money following china boom. So, is this australia fund better or china fund better? :)

as said, china is black horse, if he run out and take over US's status, then close eyes oso know it should give much much return compare to australia. BUT higher return normally comes together with higher risk. What if the black horse still takes years to shine? what if the black horse will have a crisis before it shine? china properties, especially at those big city, is damn expensive, although US properties crisis did help to cut down its price, but it is still expensive, will it collapse like US? who know?

:)

as mentioned above, the australia dynamic fund ranked top 5 since it launch, where is the china/hongkong market fund performance during these few months? below is the list:-

Fund Name Total Return

(%)

1 PSA30F 16.7503

2 PFECTF 15.9583

3 PBADF 15.6093

4 PSEASF 15.3926

5 PBADBF 14.7541 --> australia dynamic

6 PIX 14.3382

7 PGF 13.3969

8 PEF 13.0532

9 PRSEC 13.0526

10 PIF 12.9942

11 PBAEF 12.8313

12 PBCPEF 12.6805

13 PBGF 12.6411

14 PBIEF 12.5710

15 PFEPRF 12.4196

16 PBIASSF 12.3873

17 PFES 12.2753 --> far east select

18 PIOF 12.1908

19 PFEDF 12.1268 --> far east dividen

20 PSF 11.9913

21 PFETIF 11.9240

22 PIDF 11.6622

23 PBEPEF 11.6447

24 PBIAEF 11.5515

25 PIOGF 11.5190

26 PRSF 11.2400

27 PAIF 11.2313

28 PIADF 11.1626

29 PIEF 11.1563

30 PCSF 11.1492 --> china select

31 PITTIKAL 10.9449

32 PAGF 10.7922

33 PDSF 10.7445

34 PBCAEF 10.3931

35 PSSF 10.1000

36 PFSF 10.0735

37 PISEF 9.7277

38 PCTF 9.6787

39 PBBF 8.7760

40 PBF 8.5175

41 PISSF 8.4689

42 PIBF 8.3298

43 PSMALLCAP 7.9379

44 PBAREIF 7.1833

45 PCIF 7.0111

46 PISTF 6.7917

47 PIABF 6.7773

48 PFEBF 6.6983

49 PGSF 6.6558

50 PGBF 4.8338

worth diversifying to australia and NZ

ReplyDeleteboth are relatively mature economies with stable government. if i were to invest, is purely onto diversification. I'm still not familiar with their market. Except the big mining corps, australia doesn't seem to have a big famous global companies that i fancy of

I prefer equity investment

ReplyDelete