Today HAIO price further dropped since my last blog on it. I called up my broker, again, nothing much information i could get. I decided to sell half of my HAIO portfolio as technical indicator showed a lot of sell activity. I am still believe it's fundamental is quite solid. Should not be any accounting manipulation. And so far, the reason i sold it is for 2 reasons:

1. prepare buy back at lower price

2. raise fund for my right issue ;)

Wednesday, September 1, 2010

Friday, August 6, 2010

Sell HAIO?

Today HAIO stock price dropped significantly again. I bought in at RM3.5 2 days ago and today it was at ~RM3.3 translate to 6% lost for me. And my entire HAIO portfolio gain drop significantly as well. It wrote off about 55% of my gain. Should i still hold this position? is my Buy Hold strategy broken? One of my broker told me that investor were speculating some accounting fraud in HAIO after share split. I think if this true, it is very serious. Any way to detect accounting fraud? I think with my current CFA knowledge, i am still not able to detect this... share with me if you know anything about this.

Monday, July 19, 2010

CapitalMalls - IPO

CapitaMalls Malaysia Trust (CMMT) is seeking to list on the Main Market of Bursa Malaysia on 16 July

2010, with a fund size of 1,350,000,000 units, comprising:

Below are some of the data from my broker:

2010, with a fund size of 1,350,000,000 units, comprising:

- Issuance of 563,478,000 units as part of the consideration to acquire the properties from CapitaMalls Asia Limited

- IPO for the offer for sale of 786,522,000 new units, comprising the following:

- Conditional offer for sale of 719,022,000 new units to Malaysian and foreign institutional and selected investors

- Conditional offer for sale of 45,500,000 new units to eligible directors of the manager of CMMT and eligible employees of CapitaLand Retail Malaysia SB

- Public issue of 22,000,000 new units to the Malaysian public

Below are some of the data from my broker:

Monday, July 5, 2010

Stretch your Ringgit – investment & wealth management 101

Recently, i attended Yap Ming Hui talk on "Stretch your ringgit - investment & wealth management 101". He is one of Malaysia's foremost authorities on financial freedom. He is the author of five best-selling books. His latest book is Roadmap to Financial Freedom : The Ultimate Guide to Achieve Financial Freedom:

http://www.mphonline.com/books/nsearch.aspx?do=detail&pcode=9789834172442

Some of my friend able to capture few key point during his talk in Unit trust. And i would like to share with everyone who invested in Unit trust:

1) Time horizon provision

- make sure have holding power

Share Property Bond Fix deposit

Potential return H H M L

Volatility H L M L

Liquidity M L M H

The right money in the right bucket

Low risk assets – saving, current acc, fixed deposits(keep ~6months money) à liquidity (low risk low return)

Moderate risk assets – balanced investment, diversified, selected property à retirement, children’s education, wealth enhancement (consistent above average returns, limit downside risks)

High risk assets – direct stock, IPOs, single country, theme funds, lottery à high returns/thrill (high risk high return)

2) Target ROI return – align portfolio with target

Moderate risk investor targeting for 8-10% annual ROI

3) Asset allocation (diversify) avoid concentrated risk and reduce volatility

4) Best of breed funds (invest in good funds, avoid lousy funds) –choose quality investment

5) ROI optimization – optimize portfolio ROI

6) regular rebalancing – help you to buy low sell high

7) dollar cost averaging (DCA) – help you to buy more at low price

8) cost effective and efficient platform - minimize hassle and cost

one more reminder from Mr Yap: if you are not practicing 4 or 5 out of the 8 guideline, or you do not plan to practice more guideline, please do not invest in Unit trust and find other product. For sure you will lose $$.

Thursday, June 10, 2010

EPF's top 30 equity investment

I got this from my broker and found it is very useful. Below are the EPF's top 30 equity investment as 31st March 2010.

No. | Share | % Holdings |

1. | Malaysian Building Society Bhd | 67.33% |

2. | RHB Capital Bhd | 56.14% |

3. | Malaysian Resources Corp Bhd | 41.54% |

4. | Media Prima Bhd | 24.10% |

5. | WCT Bhd | 22.89% |

6. | IJM Corporation Bhd | 19.85% |

7. | Cycle & Carriage Bintang Bhd | 19.09% |

8. | Star Publication (M) Bhd | 17.37% |

9. | Tenaga Nasional Bhd | 16.83% |

10. | Digi.Com Bhd | 16.79% |

11. | Axiata Group Bhd | 16.58% |

12. | Shell Refining Co. Bhd | 16.31% |

13. | UMW Holdings Bhd | 16.10% |

14. | Public Bank Bhd | 16.00% |

15. | Petronas Gas Bhd | 15.65% |

16. | Proton Holdings Bhd | 15.49% |

17. | CIMB Group Holding Bhd | 15.41% |

18. | Dialog Group Bhd | 15.30% |

19. | Alliance Financial Group Bhd | 15.27% |

20. | Genting Plantation Bhd | 15.14% |

21. | Kuala Lumpur Kepong Bhd | 14.86% |

22. | SP Setia Bhd | 14.71% |

23. | Sime Darby Bhd | 14.61% |

24. | United Plantations Bhd | 14.36% |

25. | Malaysian Airlines Systems Bhd | 13.66% |

26. | Puncak Niaga Holdings Bhd | 13.53% |

27. | AMMB Holdings Bhd | 13.33% |

28. | Axis Reit Managers Bhd | 13.23% |

29. | Sunrise Bhd | 13.21% |

30. | IOI Corporation Bhd | 13.15% |

Monday, May 17, 2010

2010/05/18 News Update

Euro sinks to four year low as Europe debt crisis cause investors to pull more money from stocks, preferring gold and Asian bonds instead.

US closed +5.67 to 10,625.83 on 17/5/2010

Crude oil +0.48 to USD70.56 per barrel

US bond sales revive as Europe contagion concern recades: credit markets/ Bloomberg

Japanese stocks climb as Yen weakens; inpex falls on lower crude oil price/ Bloomberg

Samsung may become 'uncatchable' with $15.6bil capital spending plan/ Bloomberg

Asia should consider using capital controls to limit inflows, ADB advises/ Bloomberg

Japanese demand for services slipped 3% in March, second month of decline/ Bloomberg

US stocks gain as Euro rebounds from four year low; oil retreats/ Bloomberg

MISC buys stake in VTTI for US$735m/ the star

- move in line with shipping firms's strategy to grow tank terminal business

Credit Suisse says HLB's offer price for EON Cap too low

Alliance identifies Sng as its new CEO

Compensation noost for MAS

- Its Q1 net profit of RM310m due to delay in A380 delivery

MAHB net profit dragged down by FRS139

Shanghai, Shenzen lead fall in Asian markets

- investors resumed selling on risky bets that included emerging market equities and commodities amid growing fears that the sovereign debt crisis in Europe would derail global economic growth

Forex swings to hit exporters

- Firms are more exposed to fluctuations in US dollar than to Euro or Pound

- the Euro and Pound are expected to remain weak in the near term

No impact from Thai turmoil

- but Malaysian companies will be affected if the situation worsens, says FMM

Analysts positive on F&N glass divestment plan

Adamus takeover bid for M3nergy at RM1.85 per share

April vehicle sales up

- buyers rushed to take delivery before interest rates hike

Asia urged to be more assertive in global economy

Reject unfair offer by Lonbisco, TPC shareholders advised

Talks still on for sale of RBS assets

- No target date for proposed disposal to materialise, announcement in due course

Xinquan Q3 net profit up 46%

made a net profit of RM32.7mil

Salcon clinches RM84.21mil project

- from Pengurusan Aset Air Bhd for alternative water supply to the KL International Airport

Prudential launches US$21bil cash call

- move to woo shareholders' backing for its AIA acquisition

Big bargains from Europe/ the star

- the Euro's fall made eurozone assets attractive and boosted exports

Monday, May 10, 2010

7 Mistakes to Avoid???

Some good sharing on what i read. In a lot of ways investing is like badminton match in our recent Thomas Cup 2010. In badminton, having a killer serve or smash technique will win you a lot of points. But it does not mean you are the winner at the end of the day. It's often the player with the least mistakes who wins ;)

Below are some of the temptations:

1. Swinging for the fences - buy great company with economy moats. Do not load portfolio with risky and swinging for the fences on every pitch.

2. Believing that it's different this time - example year 2000 on semiconductor stocks.

3. Falling in love with products

4. Panicking when the market is down

5. Trying to time the market

6. Ignoring valuation

7. Relying on earning for the whole story

Below are some of the temptations:

1. Swinging for the fences - buy great company with economy moats. Do not load portfolio with risky and swinging for the fences on every pitch.

2. Believing that it's different this time - example year 2000 on semiconductor stocks.

3. Falling in love with products

4. Panicking when the market is down

5. Trying to time the market

6. Ignoring valuation

7. Relying on earning for the whole story

Know When to sell?

One of the investor asked this "what is your exit strategy?" I told him i got very good answer in one of the book i am reading. I think these are very true and i would like to share with the readers.

Ideally, we'd all hold our investments forever, but the reality is that few companies are worth holding for decades. The author point out when you shouldn't sell ;)

1. The Stock has dropped.

2. The stock has skyrocketed

3. Did you make a mistake?

4. Have the fundamentals deteriorated?

5. Has the stock risen too far above intrinsic value?

6. Is there something better you can do with the money?

7. Do you have too much money in one stock?

Ideally, we'd all hold our investments forever, but the reality is that few companies are worth holding for decades. The author point out when you shouldn't sell ;)

1. The Stock has dropped.

2. The stock has skyrocketed

3. Did you make a mistake?

4. Have the fundamentals deteriorated?

5. Has the stock risen too far above intrinsic value?

6. Is there something better you can do with the money?

7. Do you have too much money in one stock?

Friday, May 7, 2010

2010/05/07 News Update

US closed -347.80 to 10,502.32 on 6/5/2010

Crude oil -USD2.86 to USD77.11 per barrel

US stocks plung before parring losses/ Bloomberg

- US stocks tumbled the most in a year on concern Europe's debt crisis will halt the global recovery. The selloff briefly erased more than $1trillion in market value as the Dow Jones Industrial Average fell almost 1,000 points, a 9.2% plunge that was its biggest intraday percentage loss since 1987, before paring the drop

Electronic Trading to blame for Stock Market plunge, NYSE's Leibowitz says

Nasdaq to cansel trades of stocks moving more than 60% in market plunge

China's accelerating producer prices may show yuan peg stoking inflation

Europe equity fund outflows jump to $2bil in week on Greece concerns

Swire properties pulls $2.7bil Hong Kong offers as IPO slump deepens

Euro set to rally above $1.30 after 'excessive' slide: Technical analysis

Crude oil may slide to $60 after biggest three day decline in 15 months

Citigroup finds 'no evidence' bank was invloved in Erroneous stock traders

Greek violence threatens to scare away tourists needed for saving economy

US Stocks plunge most in year as 'panic selling' grips market

Maxis testing 4G technology./ The Star

-Celco also conducting trials for IPTV as part of growth strategy.

Experts confident of Asia's long term fundamentals./ The Star

-Market observers are confident that the long term fundamentals in Asia outweigh any temporary sell-down due to the Greek debt crisis.

Intel to close R&D unit in Kulim Hi-tech Park./ The Star

-According to the source, Intel would gradually close the unit over the next 12mths.

-The workdone at the KHTP facility would be transferred back to Arizona.

FTA talks with EU enter second round./ The Star

-Envoy says a successful agreement will benefit bilateral trade.

TM to maintain dividend at last year's level./ The Star

-the company aims to stick to its dividend payout policy of a minimum RM700mil or up to 90% of normalised profit after tax.

Higher LNG profit lifts MISC earnings./ The Star

-MISC posted a 36.5% jump in its net profit to RM196.4mil and recommeded a final dividend of 20sen per share tax exempt.

Economist: Q1 GDP seen at over 9%./ The Star

Maxbiz escapes suspension./ The Star

TH Plantations to grow landbank to 50,000 in 2year./ The Star

Stock market heading for better times./ The Star

-Petronas listing in H2 will spill over into the oil and gas play.

Ijm unit bags RM247mil Sarawak road contracts/ The Star

-2 other firm also win jobs for the Murun dam access road.

M-sport plans 1 for 4 rights issue./ The Star

Sarawak Cable plans two new products./ The Star

Bank Islam eyes stake in PT Bank Muamalat./ The Star

-Midest investors also interested in Indonesia's biggest islamic bank.

The Sabah factor in Petra Energy's plans./ The Star

BiotechCorp to focus on commercialising local research./ The Star

Sunday, January 3, 2010

Bank Negara warns of illegal currency trading scheme? Malaysia Illegal Forex Trading?

I got this article from one of the investor. i think it is good to share this information with the reader ;)

Bank Negara Malaysia has advised the public to not participate in any illegal investment or training programme on foreign currency trading offered by individuals or companies.

In a statement today, the central bank said members of the public are usually enticed to attend such investment or training programmes with promises of quick and good returns.

It said the modus operandi of such programmes has been to offer free training, seminars or workshops to lure investors, prior to inviting them to set-up an online foreign currency trading account with a principal company.

The company has purportedly a valid licence to trade in foreign currency overseas.

It also includes providing convenient access to the principal company's website and facilitates online foreign currency trading by investors as well as the recruitment of fresh graduates as marketing executives.

The graduates are also encouraged to get their family and friends to trade in foreign currency.

Such programmes also require investors to deposit an amount of money into a bank account to begin the trading in foreign currency and subsequently, requesting for a top up on their initial investment (margin call) to avoid losing the capital.

Under the Exchange Control Act 1953 (ECA), it is an offence for a person in Malaysia to buy or sell foreign currency or engage in any act which involves, is in association with, or is preparatory to, the buying or selling of foreign currency with any person, other than an authorised dealer.

It is also an offence for a person to aid or abet another to buy or sell foreign currency with anyone, unless the individual is an authorised dealer.

The list of authorised dealers and financial institutions permitted by the Controller of Foreign Exchange to buy or sell foreign currency can be obtained from Bank Negara's website (http://www.bnm.gov.my/fxadmin).

Source from:

http://www.malaysiakini.com/news/121062

Bank Negara Malaysia has advised the public to not participate in any illegal investment or training programme on foreign currency trading offered by individuals or companies.

In a statement today, the central bank said members of the public are usually enticed to attend such investment or training programmes with promises of quick and good returns.

It said the modus operandi of such programmes has been to offer free training, seminars or workshops to lure investors, prior to inviting them to set-up an online foreign currency trading account with a principal company.

The company has purportedly a valid licence to trade in foreign currency overseas.

It also includes providing convenient access to the principal company's website and facilitates online foreign currency trading by investors as well as the recruitment of fresh graduates as marketing executives.

The graduates are also encouraged to get their family and friends to trade in foreign currency.

Such programmes also require investors to deposit an amount of money into a bank account to begin the trading in foreign currency and subsequently, requesting for a top up on their initial investment (margin call) to avoid losing the capital.

Under the Exchange Control Act 1953 (ECA), it is an offence for a person in Malaysia to buy or sell foreign currency or engage in any act which involves, is in association with, or is preparatory to, the buying or selling of foreign currency with any person, other than an authorised dealer.

It is also an offence for a person to aid or abet another to buy or sell foreign currency with anyone, unless the individual is an authorised dealer.

The list of authorised dealers and financial institutions permitted by the Controller of Foreign Exchange to buy or sell foreign currency can be obtained from Bank Negara's website (http://www.bnm.gov.my/fxadmin).

Source from:

http://www.malaysiakini.com/news/121062

Friday, January 1, 2010

FBM KLCI closes year up 45% year 2009. Malaysia Market Outlook for 2010?

ilearn2invest wishes everyone: Happy New Year! 2009 is now gone. 2010 has just begun. Let's hope the new year is a brighter year with plenty of opportunities and may the new year filled with peace, prosperity and happiness for all.

2009 Review:

Shares on Bursa Malaysia traded mixed on Thursday, Dec 31, the last day of trading for the year, bucking the uptrend of most regional bourses. There were few leads for investors ahead of the long weekend, especially with some bourses already closed for the year and some on shortened trading hours. Overnight, Wall Street's major indices closed flat on light volume despite positive economic data on the manufacturing sector. The Chicago purchasing manager's index rose to 60 in December from 56.1 in November, the highest since January 2006 and above expectations. Except at the opening and closing minutes, the FBM KLCI was in negative territory almost the entire day. A late surge of buying interest lifted the benchmark index up 1.7 points at 1,272.8. Market breadth was broadly mixed throughout the day, but turned positive at the close with advancing stocks beating declining ones by a three-to-two ratio. Volume rose from 586 million to 602 million shares. Lower liners made up most of the actively traded stocks, such as Linear, IRCB, SAAG, Ho Hup and KNM. Major gainers include Manulife, Rubberex and its warrants, DiGi, KPJ and Public Bank-foreign. Losers include Hai-O, MAS and MISC. Thursday's performance caps a very good year for the local stock market, and indeed global equity bourses for 2009. The year started off on a bad note as the financial crisis was in full storm following the collapse of Lehman Brothers in Sept 2008, with declines extending into March before rebounding strongly. For the year, the FBM KLCI gained a total of 396 points or 45.2% after rising from 876.8 at the start of the year and ending at 1,272.8. At its lowest point, the index fell to 838 in March. While the gains were slightly less than most regional bourses, it should be noted that the local stock market and domestic economy was also relatively more resilient during the crisis. As a comparison, key market indices in China, India, Taiwan and Indonesia surged 78% to 87% for the year. Hong Kong was up 52%, South Korea rose 50% and Singapore was up 64%, but Japan lagged the region with only a 19% gain.

Overview - Malaysia Sector Outlooks for 2010

Malaysia Bank Sector Outlook for 2010 - Overweight

Malaysia Energy Sector Outlook for 2010 - Marketweight

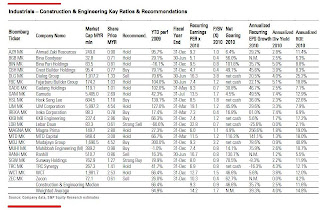

Malaysia Construction Sector Outlook for 2010 - Overweight

Malaysia Transportation Sector Outlook for 2010 - Underweight

Malaysia Information Technology Sector Outlook for 2010 - Underweight

Malaysia Telecom Sector Outlook for 2010 - Underweight

Malaysia Utilities Sector Outlook for 2010 - Marketweight

2009 Review:

Shares on Bursa Malaysia traded mixed on Thursday, Dec 31, the last day of trading for the year, bucking the uptrend of most regional bourses. There were few leads for investors ahead of the long weekend, especially with some bourses already closed for the year and some on shortened trading hours. Overnight, Wall Street's major indices closed flat on light volume despite positive economic data on the manufacturing sector. The Chicago purchasing manager's index rose to 60 in December from 56.1 in November, the highest since January 2006 and above expectations. Except at the opening and closing minutes, the FBM KLCI was in negative territory almost the entire day. A late surge of buying interest lifted the benchmark index up 1.7 points at 1,272.8. Market breadth was broadly mixed throughout the day, but turned positive at the close with advancing stocks beating declining ones by a three-to-two ratio. Volume rose from 586 million to 602 million shares. Lower liners made up most of the actively traded stocks, such as Linear, IRCB, SAAG, Ho Hup and KNM. Major gainers include Manulife, Rubberex and its warrants, DiGi, KPJ and Public Bank-foreign. Losers include Hai-O, MAS and MISC. Thursday's performance caps a very good year for the local stock market, and indeed global equity bourses for 2009. The year started off on a bad note as the financial crisis was in full storm following the collapse of Lehman Brothers in Sept 2008, with declines extending into March before rebounding strongly. For the year, the FBM KLCI gained a total of 396 points or 45.2% after rising from 876.8 at the start of the year and ending at 1,272.8. At its lowest point, the index fell to 838 in March. While the gains were slightly less than most regional bourses, it should be noted that the local stock market and domestic economy was also relatively more resilient during the crisis. As a comparison, key market indices in China, India, Taiwan and Indonesia surged 78% to 87% for the year. Hong Kong was up 52%, South Korea rose 50% and Singapore was up 64%, but Japan lagged the region with only a 19% gain.

Overview - Malaysia Sector Outlooks for 2010

Malaysia Bank Sector Outlook for 2010 - Overweight

Malaysia Energy Sector Outlook for 2010 - Marketweight

Malaysia Construction Sector Outlook for 2010 - Overweight

Malaysia Transportation Sector Outlook for 2010 - Underweight

Malaysia Information Technology Sector Outlook for 2010 - Underweight

Malaysia Telecom Sector Outlook for 2010 - Underweight

Malaysia Utilities Sector Outlook for 2010 - Marketweight

Subscribe to:

Posts (Atom)