I got this article from one of the investor. i think it is good to share this information with the reader ;)

Bank Negara Malaysia has advised the public to not participate in any illegal investment or training programme on foreign currency trading offered by individuals or companies.

In a statement today, the central bank said members of the public are usually enticed to attend such investment or training programmes with promises of quick and good returns.

It said the modus operandi of such programmes has been to offer free training, seminars or workshops to lure investors, prior to inviting them to set-up an online foreign currency trading account with a principal company.

The company has purportedly a valid licence to trade in foreign currency overseas.

It also includes providing convenient access to the principal company's website and facilitates online foreign currency trading by investors as well as the recruitment of fresh graduates as marketing executives.

The graduates are also encouraged to get their family and friends to trade in foreign currency.

Such programmes also require investors to deposit an amount of money into a bank account to begin the trading in foreign currency and subsequently, requesting for a top up on their initial investment (margin call) to avoid losing the capital.

Under the Exchange Control Act 1953 (ECA), it is an offence for a person in Malaysia to buy or sell foreign currency or engage in any act which involves, is in association with, or is preparatory to, the buying or selling of foreign currency with any person, other than an authorised dealer.

It is also an offence for a person to aid or abet another to buy or sell foreign currency with anyone, unless the individual is an authorised dealer.

The list of authorised dealers and financial institutions permitted by the Controller of Foreign Exchange to buy or sell foreign currency can be obtained from Bank Negara's website (http://www.bnm.gov.my/fxadmin).

Source from:

http://www.malaysiakini.com/news/121062

Sunday, January 3, 2010

Friday, January 1, 2010

FBM KLCI closes year up 45% year 2009. Malaysia Market Outlook for 2010?

ilearn2invest wishes everyone: Happy New Year! 2009 is now gone. 2010 has just begun. Let's hope the new year is a brighter year with plenty of opportunities and may the new year filled with peace, prosperity and happiness for all.

2009 Review:

Shares on Bursa Malaysia traded mixed on Thursday, Dec 31, the last day of trading for the year, bucking the uptrend of most regional bourses. There were few leads for investors ahead of the long weekend, especially with some bourses already closed for the year and some on shortened trading hours. Overnight, Wall Street's major indices closed flat on light volume despite positive economic data on the manufacturing sector. The Chicago purchasing manager's index rose to 60 in December from 56.1 in November, the highest since January 2006 and above expectations. Except at the opening and closing minutes, the FBM KLCI was in negative territory almost the entire day. A late surge of buying interest lifted the benchmark index up 1.7 points at 1,272.8. Market breadth was broadly mixed throughout the day, but turned positive at the close with advancing stocks beating declining ones by a three-to-two ratio. Volume rose from 586 million to 602 million shares. Lower liners made up most of the actively traded stocks, such as Linear, IRCB, SAAG, Ho Hup and KNM. Major gainers include Manulife, Rubberex and its warrants, DiGi, KPJ and Public Bank-foreign. Losers include Hai-O, MAS and MISC. Thursday's performance caps a very good year for the local stock market, and indeed global equity bourses for 2009. The year started off on a bad note as the financial crisis was in full storm following the collapse of Lehman Brothers in Sept 2008, with declines extending into March before rebounding strongly. For the year, the FBM KLCI gained a total of 396 points or 45.2% after rising from 876.8 at the start of the year and ending at 1,272.8. At its lowest point, the index fell to 838 in March. While the gains were slightly less than most regional bourses, it should be noted that the local stock market and domestic economy was also relatively more resilient during the crisis. As a comparison, key market indices in China, India, Taiwan and Indonesia surged 78% to 87% for the year. Hong Kong was up 52%, South Korea rose 50% and Singapore was up 64%, but Japan lagged the region with only a 19% gain.

Overview - Malaysia Sector Outlooks for 2010

Malaysia Bank Sector Outlook for 2010 - Overweight

Malaysia Energy Sector Outlook for 2010 - Marketweight

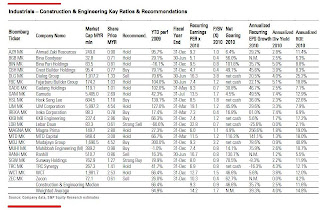

Malaysia Construction Sector Outlook for 2010 - Overweight

Malaysia Transportation Sector Outlook for 2010 - Underweight

Malaysia Information Technology Sector Outlook for 2010 - Underweight

Malaysia Telecom Sector Outlook for 2010 - Underweight

Malaysia Utilities Sector Outlook for 2010 - Marketweight

2009 Review:

Shares on Bursa Malaysia traded mixed on Thursday, Dec 31, the last day of trading for the year, bucking the uptrend of most regional bourses. There were few leads for investors ahead of the long weekend, especially with some bourses already closed for the year and some on shortened trading hours. Overnight, Wall Street's major indices closed flat on light volume despite positive economic data on the manufacturing sector. The Chicago purchasing manager's index rose to 60 in December from 56.1 in November, the highest since January 2006 and above expectations. Except at the opening and closing minutes, the FBM KLCI was in negative territory almost the entire day. A late surge of buying interest lifted the benchmark index up 1.7 points at 1,272.8. Market breadth was broadly mixed throughout the day, but turned positive at the close with advancing stocks beating declining ones by a three-to-two ratio. Volume rose from 586 million to 602 million shares. Lower liners made up most of the actively traded stocks, such as Linear, IRCB, SAAG, Ho Hup and KNM. Major gainers include Manulife, Rubberex and its warrants, DiGi, KPJ and Public Bank-foreign. Losers include Hai-O, MAS and MISC. Thursday's performance caps a very good year for the local stock market, and indeed global equity bourses for 2009. The year started off on a bad note as the financial crisis was in full storm following the collapse of Lehman Brothers in Sept 2008, with declines extending into March before rebounding strongly. For the year, the FBM KLCI gained a total of 396 points or 45.2% after rising from 876.8 at the start of the year and ending at 1,272.8. At its lowest point, the index fell to 838 in March. While the gains were slightly less than most regional bourses, it should be noted that the local stock market and domestic economy was also relatively more resilient during the crisis. As a comparison, key market indices in China, India, Taiwan and Indonesia surged 78% to 87% for the year. Hong Kong was up 52%, South Korea rose 50% and Singapore was up 64%, but Japan lagged the region with only a 19% gain.

Overview - Malaysia Sector Outlooks for 2010

Malaysia Bank Sector Outlook for 2010 - Overweight

Malaysia Energy Sector Outlook for 2010 - Marketweight

Malaysia Construction Sector Outlook for 2010 - Overweight

Malaysia Transportation Sector Outlook for 2010 - Underweight

Malaysia Information Technology Sector Outlook for 2010 - Underweight

Malaysia Telecom Sector Outlook for 2010 - Underweight

Malaysia Utilities Sector Outlook for 2010 - Marketweight

Subscribe to:

Posts (Atom)