Public Mutual Bhd is launching a new fund, Public Australia Equity Fund (PAUEF) on 8 September 2009 to tap into the growth potential of the Australian Market. Its chief executive officer Yeoh Kim Hong said PAUEF would give investors the opportunity to capitalise on the long-term growth potential of the Australian market, given the country's strong position in natural resources and its diversified services sector.

The fund will mainly focus on sectors such as the natural resources, banking, real estate and consumer sectors. Please refer the url for more detail.

As usual, this new fund brought up some discussion among my friends at our kopitiam session ;)

Some said "well, it's potential"

Some said "i would rather invest in China Market"

Some said "how about the predicted performance?"

Some said "i am not interested in mutual fund. i am an equity guy."

Whatever category you are, let review some data. I have compiled some of market movment of Equity Indexes that included US (DJI), Australia (S&P/ASX200), Hong Kong (HSI), Singapore (STI) and Malaysia (KLSE). I hope this data could help you up ;)

DJI

-32.2% from it's peak

+46.7% since march 2009

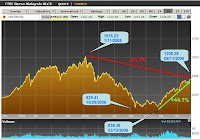

KLSE

-20.3% from it's peak

+44.1% since march 2009

Despite of the rebound since march 2009, most of the equtiy market is still underperform. Which market is more attractive to you? Another risk factor to think about it when investing oversea - currency exchange. I have compiled some of the past currency exchange data for AUD, CNY, HKD, SGD and MYR. In long term, which of the following currency will appreciate?

AUD - potential to appreciate vs the peak

SGD - potential to appreciate vs the peak